41 short call payoff diagram

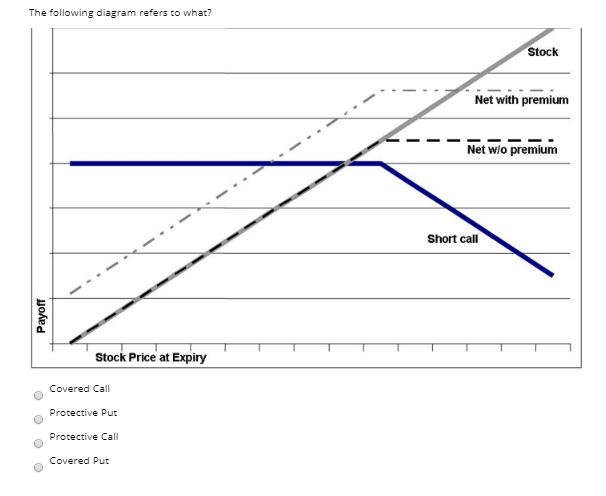

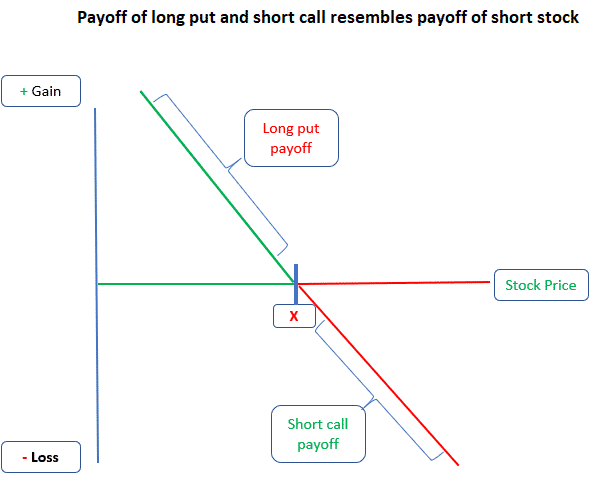

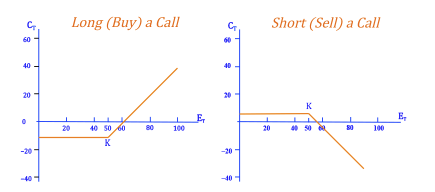

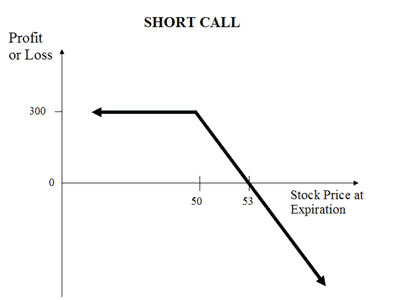

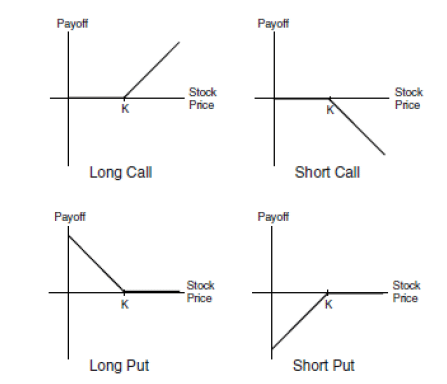

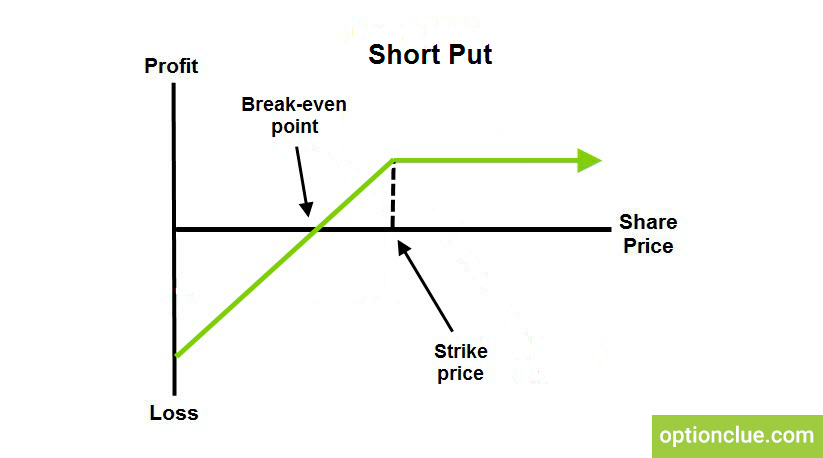

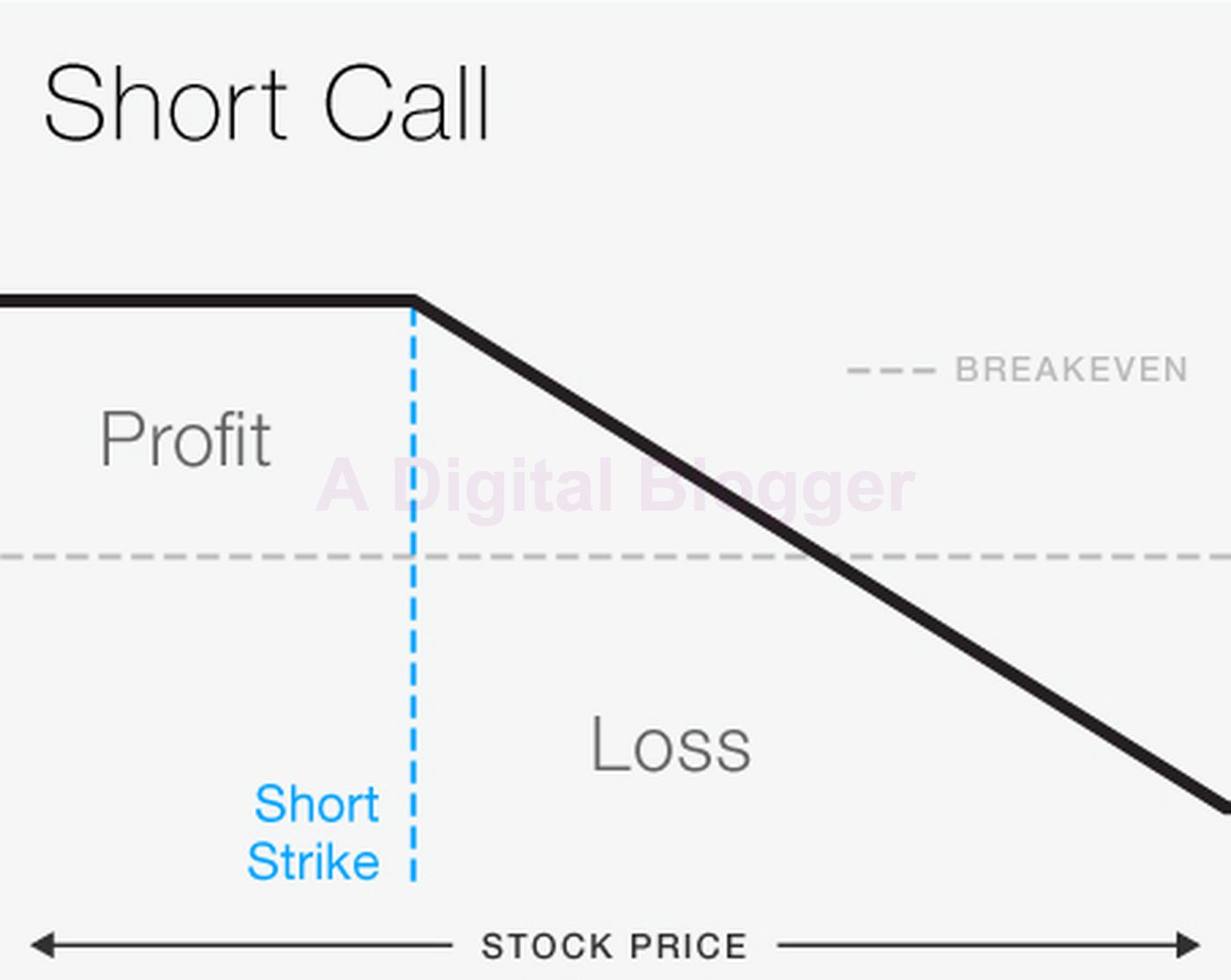

Short Call Payoff Diagram - Free Catalogs A to Z A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Short calls have a similar shaped payoff diagram to a long put. Profits are flat below the strike price with a breakeven price equal to the strike price plus the premium. How to read payoff diagrams for options contracts | Short Courses Payoff diagrams for options are more complicated than those of a futures contract. This is because the payoff structure of an options contract does not only depend on investors' long or short position in the options market, but also depends on the type of the option, ie, whether it is a call option or a put option.

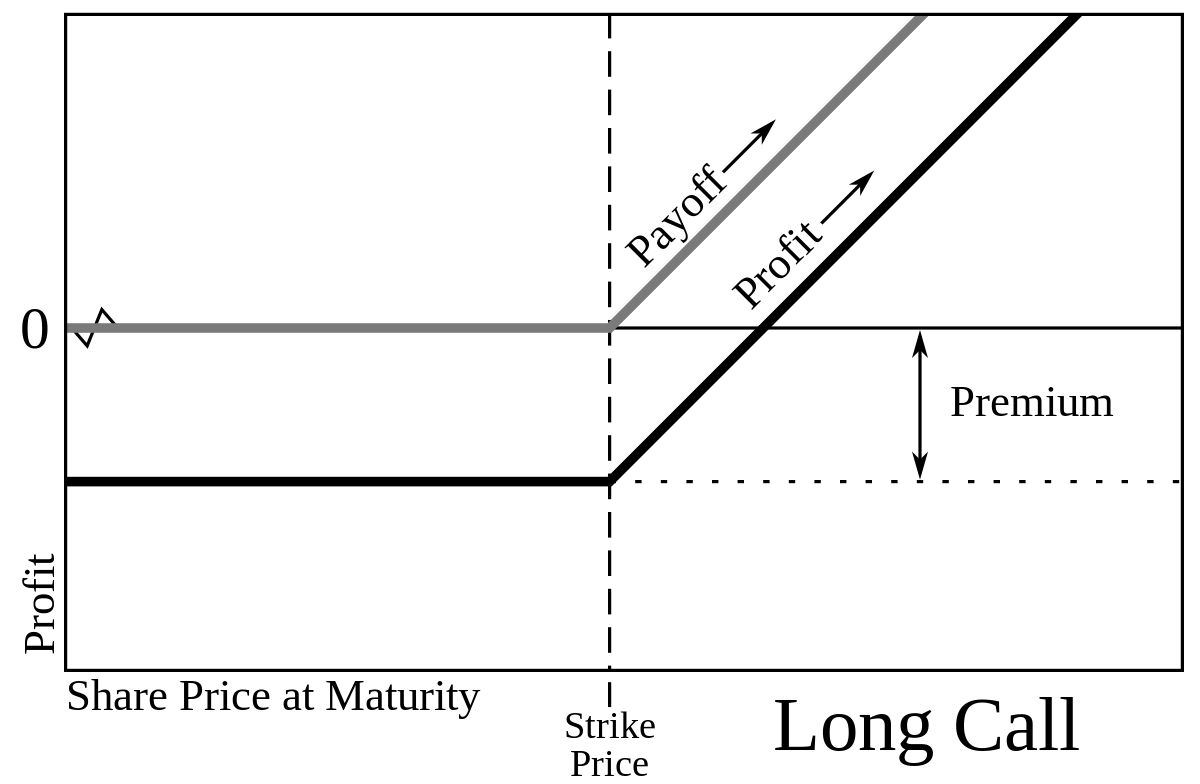

Payoff Graphs vs Profit & Loss Diagrams - Overview, Examples Payoff graphs are the graphical representation of an options payoff. They are often also referred to as "risk graphs." The x-axis represents the call or put Profit & loss diagrams are the diagrammatic representation of an options payoff, i.e., the profit gained or loss incurred on the investment made.

Short call payoff diagram

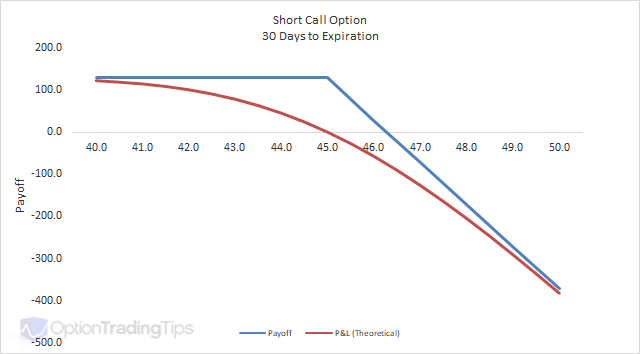

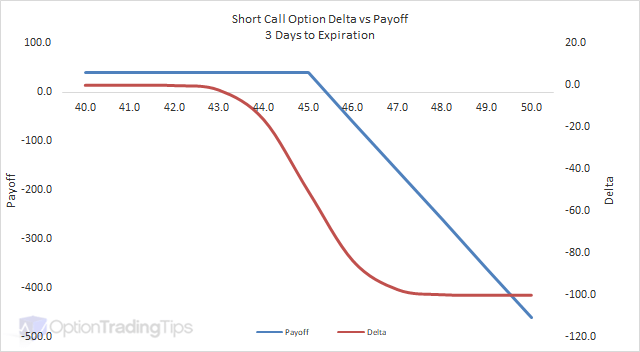

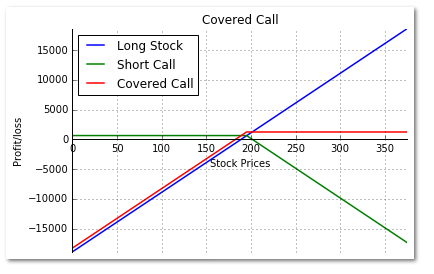

Today we're going to look at the covered call option payoff graph. Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. The maximum profit is equal to the short call strike, less the stock purchase price, plus the premium received. That occurs at an underlying stock price of $340 and above. › ~markus › teachingLecture 02: One Period Model - Princeton University Payoff/profit of a purchased call • Payoff = max [0, spot price at expiration –strike price] • Profit = Payoff –future value of option premium • Examples 2.5 & 2.6: S&R Index 6-month Call Option • Strike price = $1,000, Premium = $93.81, 6-month risk-free rate = 2% If index value in six months = $1100 Short Call Payoff Diagram The payoff diagram for a short call represents the risk involved with selling naked options. Profit potential is limited to the amount of credit received when the call is sold. However, the risk is unlimited if the underlying asset experiences an increase in price.

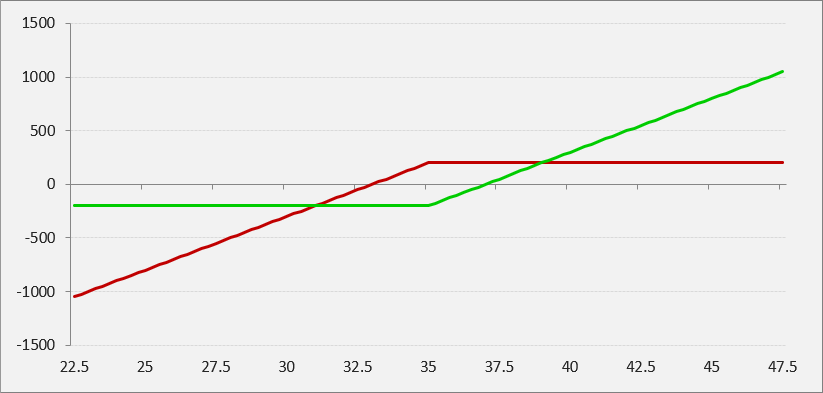

Short call payoff diagram. › payoff-diagramsUnderstanding Option Payoff Charts Option payoff diagrams are profit and loss charts that show the risk/reward profile of an option or combination of options. If you've never seen a payoff chart, then below we'll go through two examples of what the P&L looks like for an easy long call option (buying a call) and then a short call... Long vs. Short Position in a Stock - Payoff Diagrams The payoff of a short call position (writing a call) is the negative of long call (buying a call) Writing a Call vs. Writing a Put Payoff Diagrams - Symmetry? Investment Strategies A Portfolio of Investment Vehicles. We can use more than one investment vehicle to from a portfolio with the desired payoff. Short Call Option Strategy | Monthly Income Option Selling Strategy... Basics of Long Call/Put and Short Call/Put. In this video i have explained what is Long/Short call and put Option with example and payoff chart and also potential advantages and disadvantages of this strategy, and how to best implement it in your portfolio. Call Option Payoff - Finance Train | Short Call An investor can take a long or a short position in a call option. This diagram shows the option's payoff as the underlying price changes for a long call position. If the stock falls below the strike price at expiration, the option expires worthless.

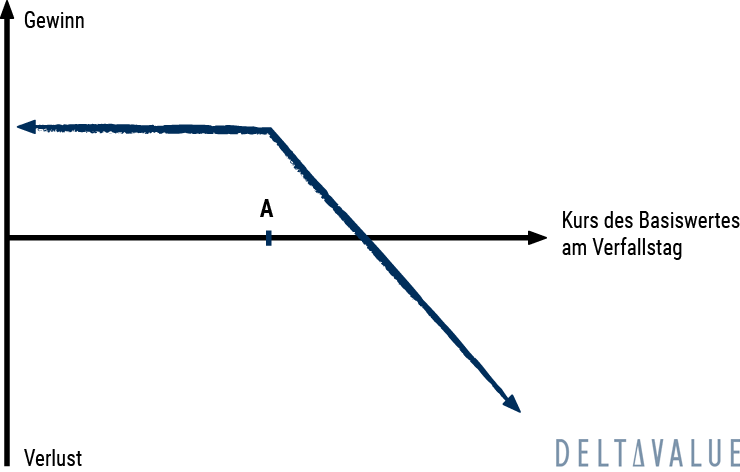

Example 1 : Call Option Buyer Payoff Diagram of Microsoft Inc. The... The payoff diagram for a single option can be plotted using the single_plotter() function. If no arguments are provided, payoff diagram for a long call option will be generated with strike price as Example 1: Short Strangle A short strangle is an options trading strategy that involve: (a)selling of a... Short Call Payoff Diagram Short call option is a short volatility strategy. Its directional and bearish. A guide to this short call options payoff using examples... When you are looking to calculate payoff for a short-call strategy, then you need to consider these major factors in your calculations optionstradingiq.comOptions Trading IQ Options Trading 101 - The Ultimate Beginners Guide To Options. Download The 12,000 Word Guide. Get It Now Summarizing Call & Put Options - Varsity by Zerodha Please find below the pay off diagrams for the four different option variants -. Arranging the Payoff diagrams in the above fashion helps us Likewise, whenever you sell an option, it is called a 'Short' position. Going by that, selling a call option and selling a put option is also called Short Call and...

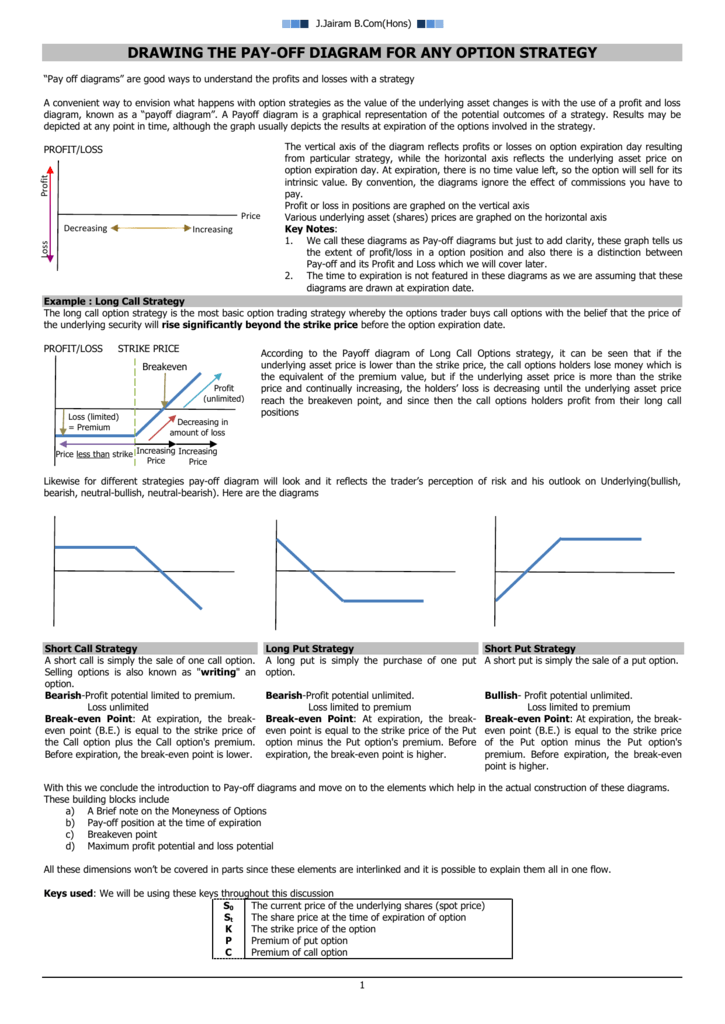

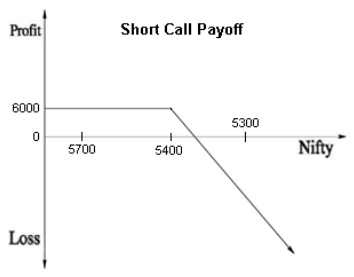

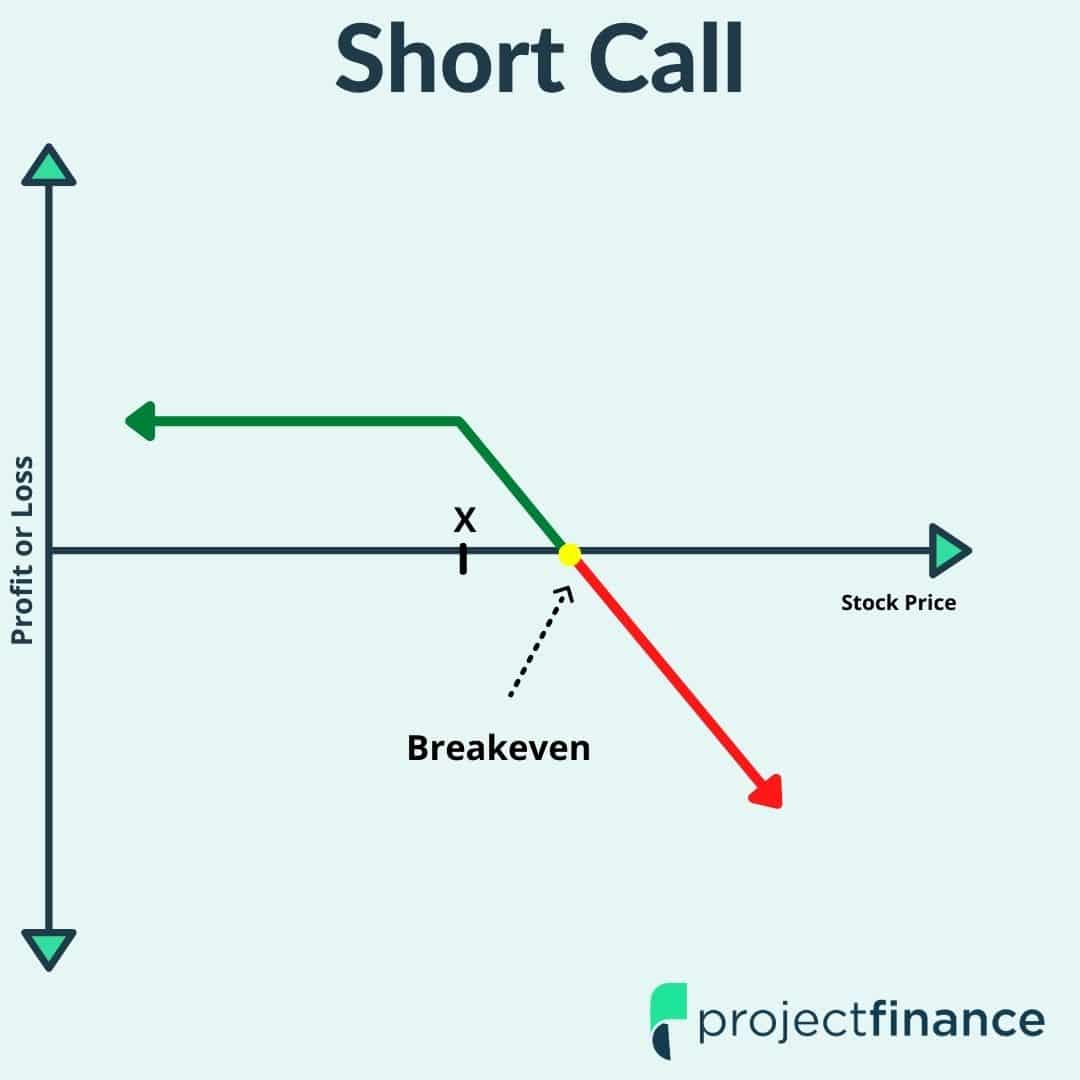

drawing the pay-off diagram for any option strategy A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the graph Here are the diagrams Short Call Strategy A short call is simply the sale of one call option. Selling options is also known as "writing" an option. optionstradingiq.com › short-strangle-strategyUltimate Guide To The Short Strangle Strategy Oct 28, 2020 · Short strangles have a payoff diagram shown with a dashed line in the graph of the SPY trade. The trade has high gamma, particularly when it approaches expiration. The ideal scenario for short strangles is when the price of the underlying stock trades in a narrow range between the breakeven points with decreasing volatility. Trading Strategies and Payoff Diagrams Flashcards | Quizlet Long Calendar Call Spread Payoff Diagram. Short Calendar Call Spread Payoff Diagram. Put Spread (PS). Involves purchasing put options at a specific strike price while also selling calls with a different strike price and/or a different expiration. Writing Call Options | Payoff | Example | Strategies writing naked call or Naked shortNaked Short Naked shorting is short selling in which the seller doesn't borrow or inquire about the asset that he Payoff for the seller is as below: Pay-off = min(X - ST, 0). Further, the payoff for writing naked call options would be as similar as writing a covered call.

Short Call Strategy Explained - Online Option Trading | 5Paisa Blog A Short Call means selling of a call option where you are obliged to buy the underlying asset at a fixed price in the future. Following is the payoff schedule assuming different scenarios of expiry. For the ease of understanding, we did not take into account commission charges and Margin.

Short Call Payoff Diagram The payoff diagram for a short call represents the risk involved with selling naked options. Profit potential is limited to the amount of credit received when the call is sold. However, the risk is unlimited if the underlying asset experiences an increase in price.

› ~markus › teachingLecture 02: One Period Model - Princeton University Payoff/profit of a purchased call • Payoff = max [0, spot price at expiration –strike price] • Profit = Payoff –future value of option premium • Examples 2.5 & 2.6: S&R Index 6-month Call Option • Strike price = $1,000, Premium = $93.81, 6-month risk-free rate = 2% If index value in six months = $1100

Today we're going to look at the covered call option payoff graph. Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. The maximum profit is equal to the short call strike, less the stock purchase price, plus the premium received. That occurs at an underlying stock price of $340 and above.

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

0 Response to "41 short call payoff diagram"

Post a Comment